Bullets:

C-suite executives across Chinese industry anticipate falling input prices as lower costs for raw materials and logistics drive efficiencies.The Cheung Kong School of Business publishes proprietary surveys of hundreds of top business managers across China, and companies report chronic falls in prices for raw and intermediate goods.But they also report difficulty in passing through these savings to bottom-line profits; consumer prices are also falling, relentlessly, economy wide.In Western economies, deflation is a signal of collapsing economic activity, and even depressions. But Chinese deflation is a result of powerful supply-side forces that have the opposite effect: China’s economy continues to grow at solid rates, while rent-seeking profits are extinguished at the company level by high competition.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

This is a transcript, for the YouTube video found here:

Report:

Good morning.

Western economists and think tanks have been predicting the demise of China’s economy for a long time. There are a handful of YouTube channels that do the same—the economy here was supposed to blow up a long time ago.

And it’s on the issue of deflation—falling prices—that commonly trips them up. Deflation is a real thing here—the prices for almost everything are gradually falling over time.

To Western economists that is a serious problem. And that’s because in the West, debt levels are a lot higher, and so in the West deflation poses a serious problem. Falling prices means lower corporate profits, or even losses, and losses mean that debts cannot be repaid, and the value of equity—stock prices—lose their premiums and fall. As debt becomes more difficult to repay, banks are more reluctant to lend, and have to write off bad debts, which means the banks themselves fail.

Inflation—the gradual erosion of the value of the currency—means that loans taken out today become easier to pay back over time. Deflation is the opposite. “Entire industries” become unstable, and recessions and even economic depressions follow, and governments race around trying to bail out banks that are going under.

So when these same observers watch the chronic, persistent deflation in China, they expect the same inevitable outcome. But it’s a different world here. We like Ryan Perkins’ take here on his Substack:

Chinese-style deflation is a result of everything supply chain—access to raw materials on a global scale. World-class infrastructure and logistics. Affordable electricity, also falling in price. A labor pool that is increasingly better educated, at far lower costs than in other countries.

These are supply-side factors that are driving costs lower, “relentlessly”. “Investments in strategic sectors have driven massive gains in efficiency and scale.” As a result, consumer prices are falling also. Household goods are less expensive, as Chinese factories are building just more of them, better, at lower costs.

He concludes there that this “deflation is a byproduct of industrial success, not a economic failure.” To Western business executives, though, it is an economic failure. Our companies expect that greater efficiencies should result in booming profits and higher stock prices, but China’s financial system is radically different too. The banks here are state-owned, mostly, so don’t run the risk of a Lehman-Brothers type contagion that blows up the whole system. Chinese banks provide the capital to aggressively expand the supply side, and remain healthy even as consumer prices fall.

But going a bit further: falling prices on homes and cars, for example, frees up consumer and household spending on electronics and clothing and vacations, and those companies are banking customers too. Those industries have millions of employees, across hundreds of thousands of small businesses who benefit from falling prices everywhere else. Yes, there is deflation, and in conventional Western thinking, the Chinese economy is growing in spite of it. But we’ve got that backwards—the Chinese economy is growing because of it.

We need a comprehensive rewrite of our understanding of China, and of deflation, and of economics in general. Our top policymakers believed that the popping of the Chinese real estate bubble would cause the economy here to collapse, because that’s what happened at home. They believed that chronic Chinese deflation would cause the economy here to collapse, because that was a feature of the Great Depression in the 1930’s. What happened instead was an industrial and supply-chain boom unprecedented in world history.

A great source of inside information is a private business school here in China. The Cheung Kong Graduate School of Business is an executive management school. They offer programs for foreigners too, in English thankfully, but most of their students and graduates are executives in Chinese companies. So far they have 23,000 graduates, and half of them are at director level or above.

For over a decade the school has done research papers and reports that tell us how the policies are playing out across industries, and even at the individual company level.

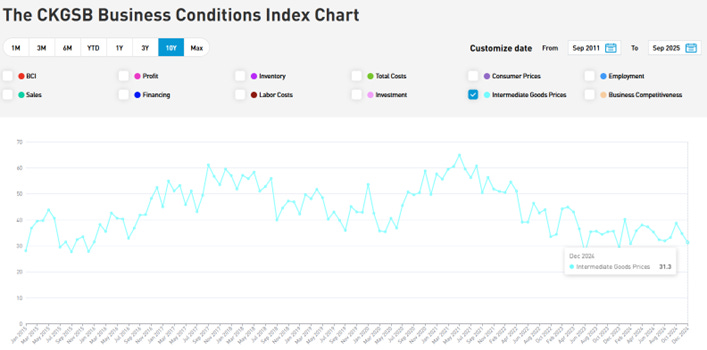

They also publish proprietary business indices, and we’ll look at a couple of them today to show the deflation phenomenon here. The Business Conditions Index works like the PPI—any reading above 50 means rising, or expansion. A value below 50 means it’s falling. So every month this survey asks top business executives about conditions in their own businesses, and these business are across the spectrum of China’s industrial sectors:

This data set above is for Intermediate Goods Prices. So they’re asking hundreds of business owners in manufacturing or wholesaling—are the prices you are paying for intermediate goods rising?—over 50; or falling?—under 50. The index value is 31.3, so economy- wide, intermediate products are falling, a lot, and almost everywhere. The last time that index was over 50 was three years ago, April 2022.

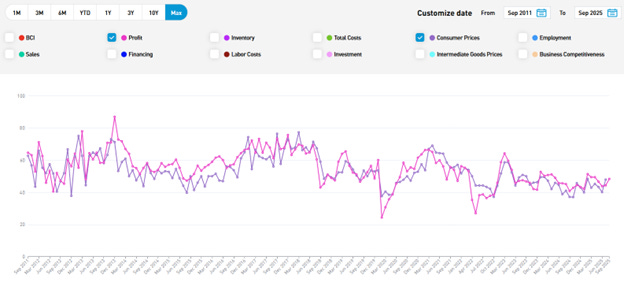

For consumer prices, they’re asking again, for the prices your company will be charging to final customers, do you expect your prices to go up?—over 50, or down? So at 47.9, these company managers are planning for lower prices. Here we’ve charted profits, in red, with consumer prices in blue. So profits are also being driven lower, along with input prices:

But let’s remember again how Chinese policymakers see these data. The supply chains are getting stronger, more efficient, and businesses expect their costs to fall over time, and are making plans accordingly. So lower corporate profits and falling consumer prices are not problems to be solved: It means that rent-seeking profits are being purged from the Chinese economy. Everything is working just as they hoped.

Be good.

**Resources and links:**Cheung Kong School of BusinessChinese: https://www.ckgsb.edu.cn/English: https://english.ckgsb.edu.cn/The CKGSB Business Conditions Index charthttps://english.ckgsb.edu.cn/knowledge/business-conditions-index/Substack, China’s Deflation Isn’t a Crisis — It’s the Price of Industrial Success

CNBC, China’s property slump is far from bottoming. But Beijing is prioritizing tech growthhttps://www.cnbc.com/2025/10/23/chinas-property-slump-is-far-from-bottoming-but-beijing-is-prioritizing-tech-growth.htmlNPR, Electric car makers in China are slashing prices in an effort to boost saleshttps://www.npr.org/2025/06/30/nx-s1-5440153/electric-car-makers-in-china-are-slashing-prices-in-an-effort-to-boost-salesChina%E2%80%99s Industry Becoming Increasingly Stronger Globally Thanks to Falling Electricity priceshttps://www.all-about-industries.com/falling-electricity-prices-china-global-competitiveness-a-678fbe59c8e3bc41253d03df59f66263/Part 2: Good and Bad Deflation–The Great depressionhttps://medium.datadriveninvestor.com/part-2-good-and-bad-deflation-the-great-depression-40e373102a62How Government Failure Caused the Great recessionhttps://www.aei.org/articles/how-government-failure-caused-the-great-recession/

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via this RSS feed

China Economic IndicatorChina’s Deflation Isn’t a Crisis — It’s the Price of Industrial SuccessFor Western economists, falling consumer prices in China set off a familiar alarm. In their textbooks, deflation is a warning light — evidence of weak demand, a spur to postponed spending and a prelude to debt distress. Yet to read China through that lens is to misdiagnose the patient. The country’s deflation has different origins and a different meanin…Read more13 days ago · 19 likes · 4 comments · Ryan Perkins

China Economic IndicatorChina’s Deflation Isn’t a Crisis — It’s the Price of Industrial SuccessFor Western economists, falling consumer prices in China set off a familiar alarm. In their textbooks, deflation is a warning light — evidence of weak demand, a spur to postponed spending and a prelude to debt distress. Yet to read China through that lens is to misdiagnose the patient. The country’s deflation has different origins and a different meanin…Read more13 days ago · 19 likes · 4 comments · Ryan Perkins